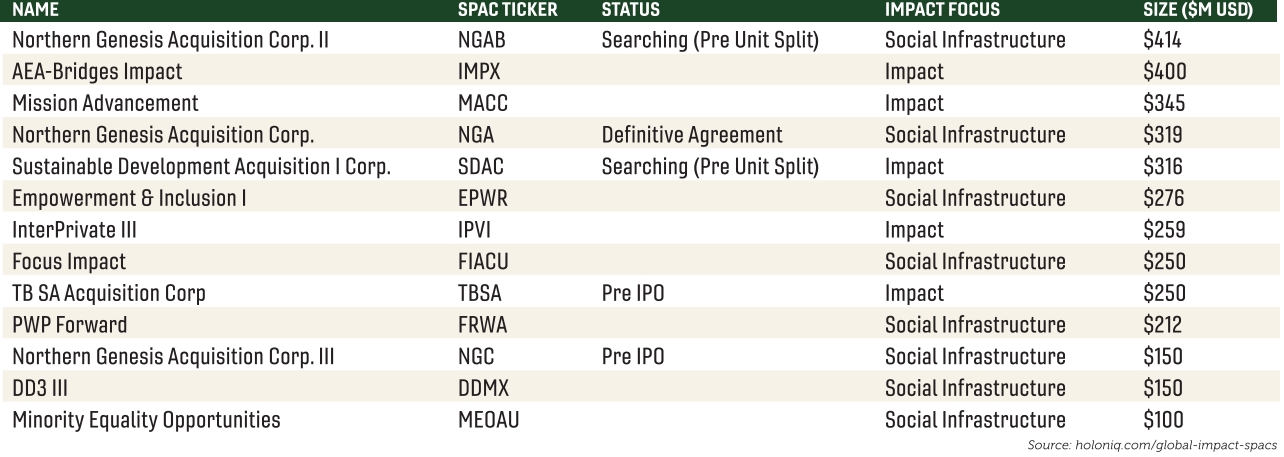

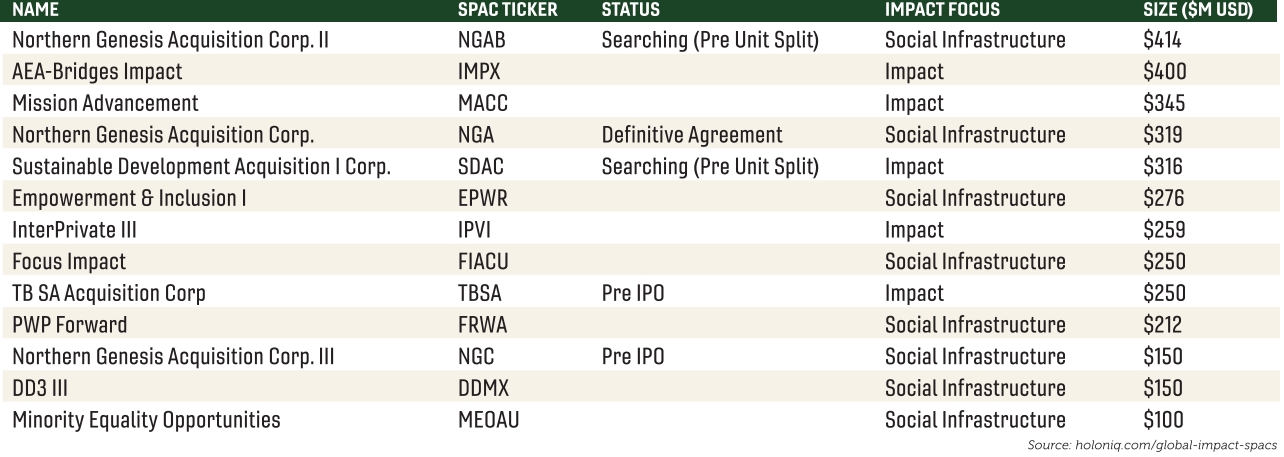

Companies with environmental, social, and governance (ESG) credentials have been high on the list of merger targets for U.S. special purpose acquisition companies (SPACs). These are a few SPACs that focus on Social Infrastructure and Impact Investing.

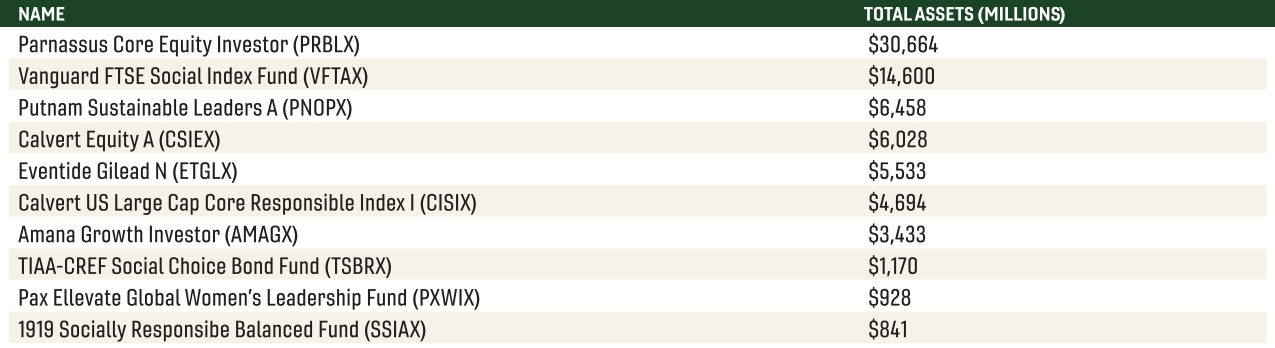

ESG mutual funds are graded using environmental, social, and governance (ESG) principles. ESG mutual funds invest in companies that aim to have a sustainable and societal impact in the world. These are a list of the top 10 who have a focus on the “S” in ESG.

Private Equity firms are moving environmental, social, and governance (ESG) issues from the periphery of strategic concern to the heart of their business strategy. While there is a lot of focus on the “E” and not enough on the “S” and the methodology can sometimes be opaque; this is the list of the top 10 Private Equity Firms that embrace ESG.

Sources

money.usnews.com/investing/funds/articles/top-10-largest-private-equity-firms

s23.q4cdn.com/714267708/files/doc_financials/2021/q3/Blackstone3Q21EarningsPressRelease.pdf

ir.kkr.com/app/uploads/2021/08/Q221-KKR-Earnings-Release_vF.pdf

ir.carlyle.com/static-files/d40af205-054f-4926-bbab-fe873a8ebfd9

apollo.com/~/media/Files/A/Apollo-V3/press-release/2021/agm-earnings-release-2q-2021.pdf

apollo.com/~/media/Files/A/Apollo-V3/press-release/2021/agm-earnings-release-2q-2021.pdf

bain.com/globalassets/noindex/2021/bain_report_2021-global-private-equity-report.pdf

*While CVC may consider ESG factors when making an investment decison, CVC does not pursue an ESG-based investment strategy or limit its investments to those that meet specific ESG criteria or standards.