Higher import volume, new laws could create a large uptick in leasing

In the vast Southern California industrial real estate market, asking rental rates hovered below historical highs as vacancy rates trended higher, and much of the new construction delivered vacant. However, higher import volume at local ports and an uptick in activity point toward improved market fundamentals. New legislation set to take effect in 2026 could increase the overall long-term value of industrial properties even while the full impact of potential tariffs on goods from China and other nations is yet to be determined.

“Despite a continued slowdown in leasing, early in 2025, we are seeing some improvement in activity in core industrial markets in Southern California, which shows stronger signs of stabilization overall,” said Jeff Chiate, executive vice chair of industrial capital markets for Cushman & Wakefield.

The overall vacancy rate in Los Angeles County was 4.9% at year-end 2024. Availability rates, which include space landlords are marketing for lease prior to tenants vacating, are typically a leading indicator for future vacancy levels. The availability rate was 6.4% for Los Angeles, up from 4.8% one year earlier. The slowdown in leasing activity has led to a decrease in asking rental rates, which have fallen for five straight quarters in Los Angeles, according to data from Cushman & Wakefield. Despite those declines, long-term rent growth spurred by the pandemic has increased rents by 54% compared with prepandemic levels.

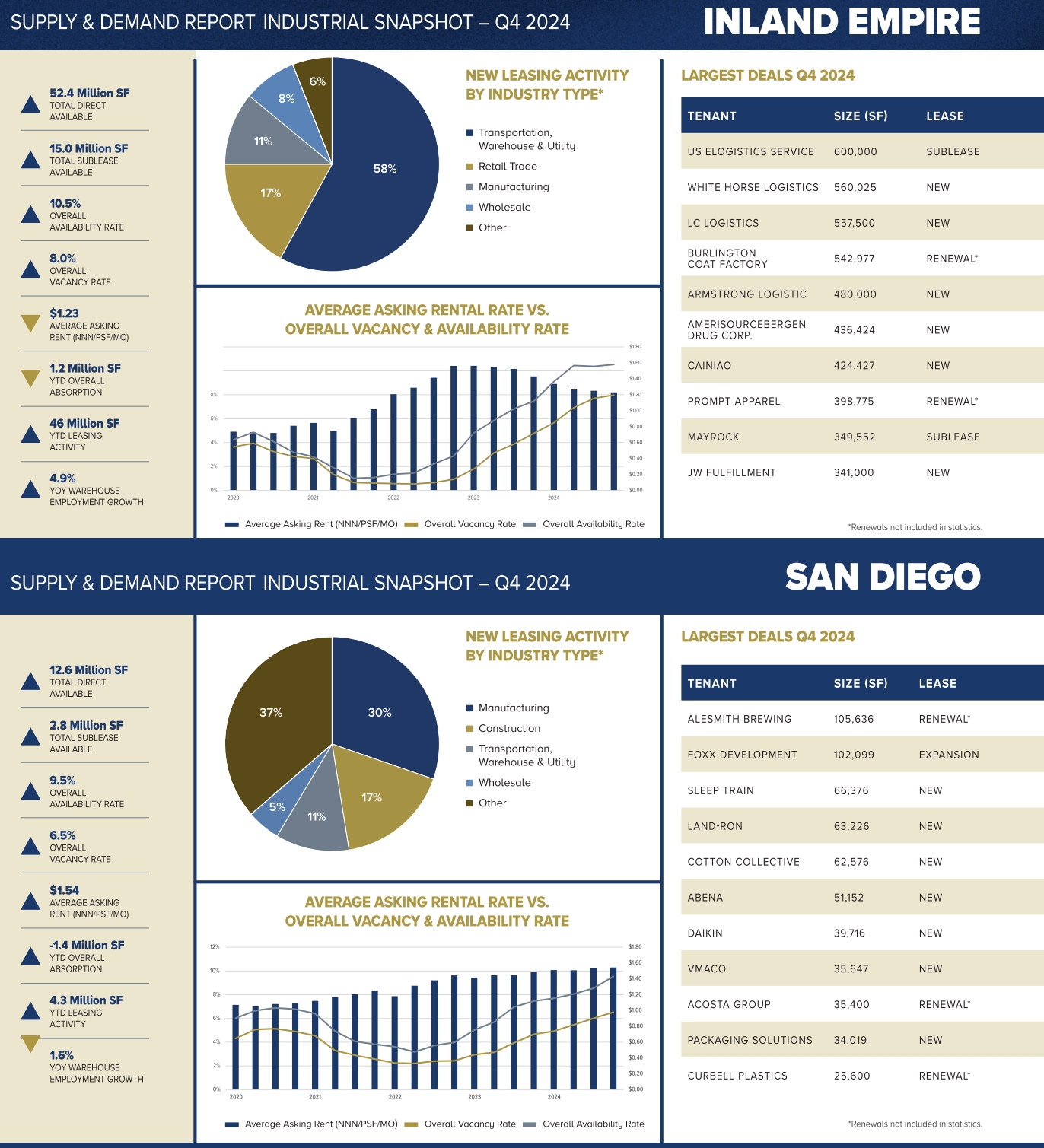

The vacancy rate in Orange County increased for the eighth consecutive quarter to 3.9%, and overall annual net absorption fell by 3.2 million square feet, which was the first annual decline since 2014. In the Inland Empire, vacancy increased by 3.2% year over year to 8.0%. Sublease space, which is placed on the market by tenants who offer their space for lease, accounted for 22% of the availability in the Inland Empire. San Diego’s overall industrial vacancy rate increased to 6.5% at year-end 2024. That’s the county’s highest vacancy rate since 2014.

Development Slowdown

Most new construction occurs in the Inland Empire, where there is more land available for industrial development and easy access to the region’s rail and highway system that allow for goods to be transported from the ports with more ease. The Inland Empire added 22.8 million square feet of industrial space in 2024 compared with 6.5 million square feet in Los Angeles County and 1.3 million square feet in OC. However, many of those buildings were vacant upon completion, and the region’s vacancy rate has moved higher. Development has decreased, and there were 12.6 million square feet under construction in the Inland Empire at the start of 2025, which represents the lowest construction level since 2014.

Construction activity in San Diego is mainly limited to areas near the border in Otay Mesa. The largest San Diego project under construction is a 1.1-million-square-foot warehouse for Amazon, which accounted for nearly half of the 2.5 million square feet underway. Proposed projects call for an additional five million square feet, but financing challenges due to high interest rates and labor shortages could delay future development projects.

Moreover, changes to state laws surrounding warehouse development will be implemented in 2026 and have the potential to drastically reduce new construction. California Assembly Bill No. 98, which passed last year and will become effective on January 1, 2026, regulates new warehouse construction and operations for properties that are 250,000 square feet or larger. Investors have reset expectations, and pricing has dropped by 30-40% from peak prices, but the market may strengthen with fewer development opportunities, according to Cushman & Wakefield’s Chiate.

“With Southern California’s industrial construction pipeline slowing dramatically, there will be limited new options in 18-24 months,” said Chiate.

-David Nusbaum