Experience a world of choice with Jumbo Loans from Union Bank

®

.

When it comes to larger loans, your options can be limited. At Union Bank, we broaden your choices and offer our most competitive rates on larger home loans. 1

Whether you’re buying or refinancing, we make our best options available to you:

Variety of Loan Programs—have more choices with an assortment of fixed- or fixed/adjustable-rate jumbo loan programs up to $5 million. Zero Point Options—reduce your out-of-pocket expenses at closing, and still get a great rate on your mortgage. Interest-Only Payment Option—make lower monthly payments and maximize your potential tax deduction. (Consult a professional tax advisor.) 2

Portfolio Lender—receive specialized underwriting on the most complex mortgages and consideration of loan amounts above $5 million, case by case.

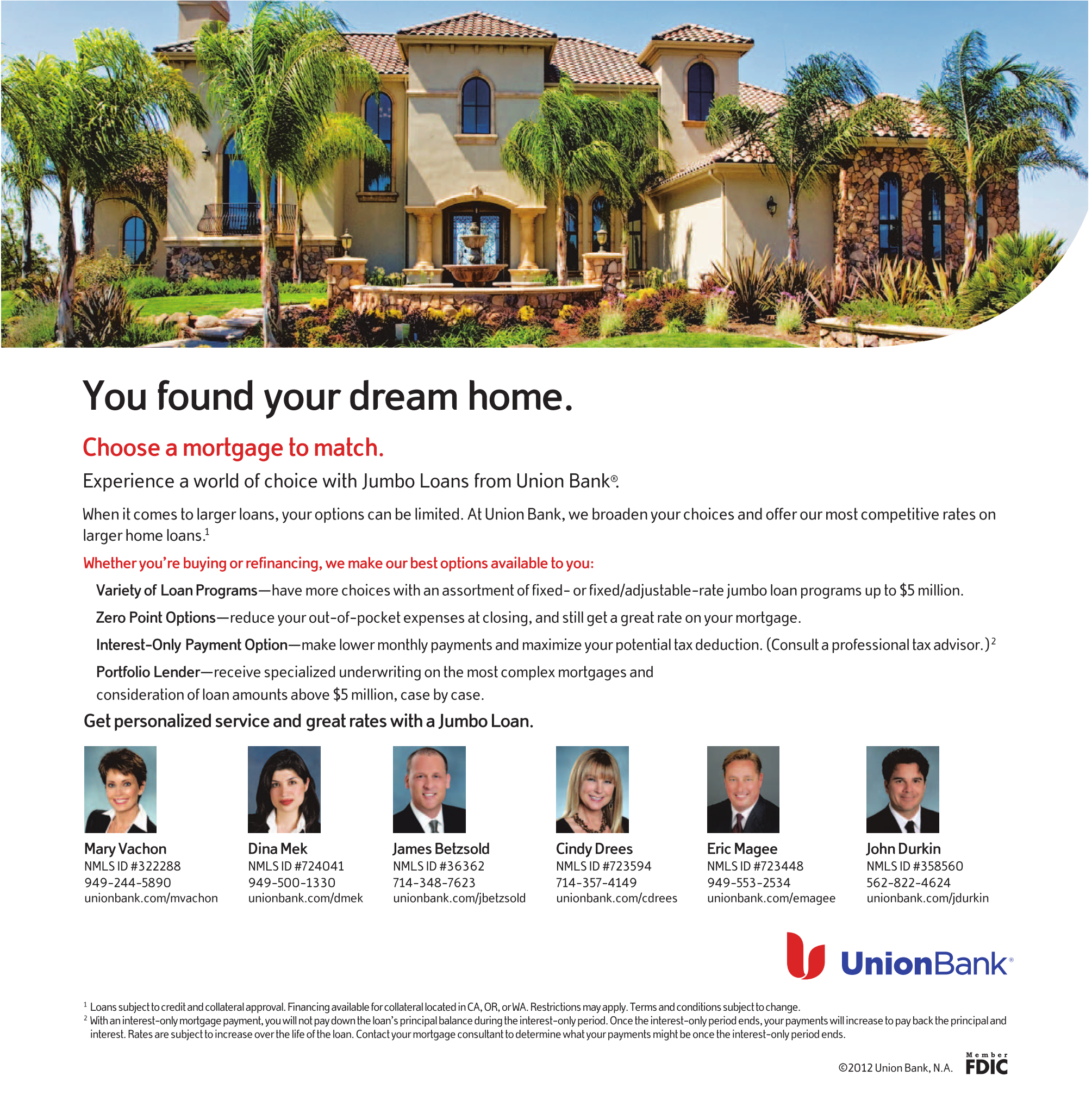

Get personalized service and great rates with a Jumbo Loan.

Mary Vachon NMLS ID #322288 949-244-5890 unionbank.com/mvachon

Dina Mek NMLS ID #724041 949-500-1330 unionbank.com/dmek

James Betzsold NMLS ID #36362 714-348-7623 unionbank.com/jbetzsold

Cindy Drees NMLS ID #723594 714-357-4149 unionbank.com/cdrees

Eric Magee NMLS ID #723448 949-553-2534 unionbank.com/emagee

John Durkin NMLS ID #358560 562-822-4624 unionbank.com/jdurkin

1 Loans subject to credit and collateral approval. Financing available for collateral located in CA, OR, or WA. Restrictions may apply. Terms and conditions subject to change.

2 With an interest-only mortgage payment, you will not pay down the loan’s principal balance during the interest-only period. Once the interest-only period ends, your payments will increase to pay back the principal and interest. Rates are subject to increase over the life of the loan. Contact your mortgage consultant to determine what your payments might be once the interest-only period ends.

©2012 Union Bank, N.A.