WORLDWIDE CONNECTIONS

PROVEN RESULTS

REAL ESTATE GUIDE

SOLD IN 9 DAYS

SOLD IN 3 DAYS

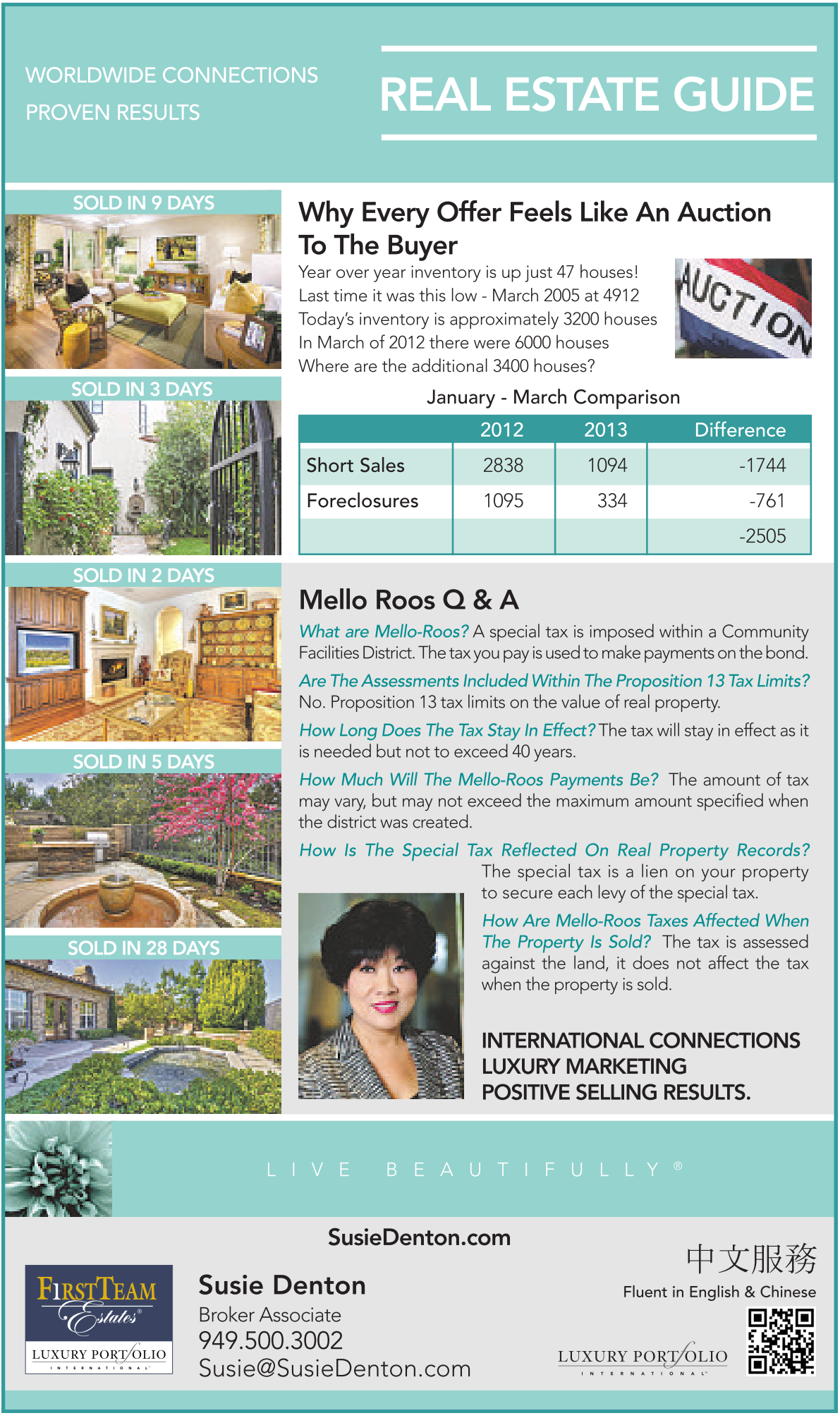

Why Every Offer Feels Like An Auction To The Buyer

Year over year inventory is up just 47 houses! Last time it was this low - March 2005 at 4912 Today’s inventory is approximately 3200 houses In March of 2012 there were 6000 houses Where are the additional 3400 houses?

January - March Comparison

2012 2013 Difference

Short Sales 2838 1094 -1744

Foreclosures 1095 334 -761

-2505

SOLD IN 2 DAYS

SOLD IN 5 DAYS

SOLD IN 28 DAYS

Mello Roos Q & A

What are Mello-Roos? A special tax is imposed within a Community Facilities District. The tax you pay is used to make payments on the bond.

AreThe Assessments Included Within The Proposition13Tax Limits? No. Proposition13tax limits on the value of real property.

How Long Does The TaxStay In Effect? The tax will stay in effect as it is needed but not to exceed 40 years.

How Much Will The Mello-Roos Payments Be? The amount of tax may vary, but may not exceed the maximum amount specified when the district was created.

How Is The Special Tax Reflected On Real Property Records?

The special tax is a lien on your property to secure each levy of the special tax.

How Are Mello-Roos Taxes Affected When The Property Is Sold? The tax is assessed against the land, it does not affect the tax when the property is sold.

INTERNATIONAL CONNECTIONS LUXURY MARKETING POSITIVE SELLING RESULTS.

L I V E B E A U T I F U L L Y ®

SusieDenton.com

Susie Denton

Broker Associate

949.500.3002 Susie@SusieDenton.com

Fluent in English & Chinese