Buyers worldwide stayed away in 2019. But bargains may bring them back.

Around the world, many rich home buyers lay low in 2019 as economic uncertainties turned some cities into risky propositions.

But don’t be surprised in 2020 to spot the world’s wealthiest people beginning to spend again as home prices in relatively stable areas continue to sink into bargain territory.

In a few cities, prices are even set to rise, according to global property consultancy Knight Frank.

Paris leads the agency’s 2020 forecast, with a 7% luxury price increase, followed by Miami and Berlin, where luxury units are relatively affordable and in short supply.

Political and economic questions still abound, including trade wars and November’s U.S. presidential election. And taxes on the rich instituted by cities such as Vancouver, London and New York will continue to weigh on sales, said Kate Everett-Allen, a Knight Frank partner in London.

“Most markets will still see prime prices increase but by smaller margins than previously,” she said.

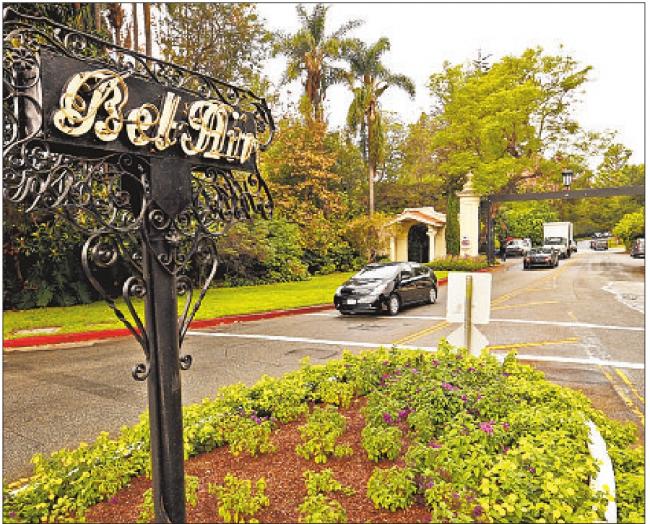

Los Angeles’ bright spot is in the $2-million to $10-million range Los Angeles’ luxury market is expected to show moderate price increases in 2020 — amounting to about 2%.

It might have been higher but for a pullback of foreign buyers, particularly Chinese citizens who face restrictions on moving money abroad. That’s tended to weaken the highest end of the market.

California’s wildfires, including one in 2018 that tore through Malibu, also have hurt by pushing up the cost of insurance, according to Philip White, chief executive of Sotheby’s International Realty.

Despite some huge deals in 2019, demand has been particularly weak for properties above $10million. Homes priced below $10 million have a more bullish outlook, according to Knight Frank.

“L.A., at present, is more of a domestic market,” White said.

New York, with a flood of new condos, is still a buyer’s market New York City prices are expected to fall 3% next year, a continuation of 2019’s trend. To sell all the newly built condos in Manhattan at the current sales pace, it would take nine years. And the uncertainty of the presidential election will probably keep buyers on the sidelines, said Jonathan Miller, president of appraiser Miller Samuel Inc.

Demand has also slipped because real estate investors have fled the market, spooked by a legislative environment that’s targeted them via more onerous rent regulations and an increased mansion tax, which leaves buyers of luxury property with higher closing costs.

“The luxury market on the sales side is the weakest segment of the housing market,” Miller said.

Without foreign buyers, Vancouver is stuck too Sellers of pricey properties in Vancouver in 2020 will probably still be feeling the hangover from the pullback of Chinese buyers and foreign buyer tax measures introduced in 2016 to cool runaway prices. Luxury values in the city will fall 5% this year, according to Knight Frank’s forecast.

On the positive side, there’s a new opportunity for domestic buyers, said Kevin Skipworth, partner and managing broker with Dexter Realty in Vancouver.

“The government has put properties on sale for those who otherwise couldn’t afford it,” he said, meaning that the tax has effectively made high-end properties cheaper for locals.

Hong Kong will deflate as political unrest spooks buyers The political unrest in Hong Kong has hurt the luxury market, but it’s still unlikely to crash in 2020, according to Knight Frank, which projects a 2% drop for luxury prices next year.

Sotheby’s White said buyers are putting purchases on hold while they watch to see what happens with the pro-democracy protests. In the meantime, they’re starting to look for opportunities in cities such as Los Angeles, San Francisco and London.

“Real estate buyers look for a stable political system, and they’re not finding that right now in Hong Kong,” he said.

Miami will see a comeback, aided by Trump’s tax overhaul Miami’s

high-end condo market is poised for a comeback in 2020, helped by

President Trump’s tax overhaul, which capped federal deductions on state

and local taxes, according to Knight Frank.

While

South Americans pulled away in recent years as the strengthening dollar

added to the cost of buying in the U.S., domestic buyers are making up

for it: Florida, which has no income tax, is drawing wealthy buyers from

high-tax states such as New York and New Jersey. Those buyers will push

up Miami high-end prices by 5% in 2020, Knight Frank said.

Central London will have modest success as Brexit plays out Central

London, where prices fell 3% in the 12 months through November, will

stabilize slightly next year as the fate of Brexit becomes clearer, said

Tom Bill, Knight Frank’s head of London residential research. Prices

are likely to rise by about 1% in 2020, according to Knight Frank

research, now that Conservatives have won in a landslide.

“Once

the Brexit deal is completed, we forecast rising momentum across all

markets, with price growth reflecting this from 2021 onwards,” the

company’s 2020 forecast report said.

The

ratio of shoppers to available listings reached a decade high in

September, a sign of rising demand. The decline in the British pound

combined with years of decreases in property prices are attracting

foreign buyers again, Bill said. “Next year we could see the disorderly

Brexit risk recede,” he said. “If that is the case, there’s an awful lot

of pent-up capital ready to buy in London, and that will translate into

higher levels of activity.”

Gopal writes for Bloomberg.