A KEY CATALYST FOR U.S. ECONOMIC GROWTH

New development of commercial real estate and of the ongoing operations of existing commercial real estate buildings in the United States – office, industrial, warehouse and retail – supported eight million American jobs, contributed $1.01 trillion to the U.S. GDP in 2020, and generated $338.1 billion in personal earnings, according to “Economic Impacts of Commercial Real Estate, 2021 U.S. Edition,” a study released earlier this year by the NAIOP Research Foundation.

The economic impact

declined slightly from 2019, when the industry supported 9.2 million

American jobs and contributed $1.14 trillion to U.S. GDP.

According

to the report, the longest economic expansion in U.S. history – 128

months – unexpectedly ended in February 2020 with the onset of the

COVID-19 pandemic. The rapid contraction of the economy beginning in

March resulted in secondquarter GDP declining 9.0% from its

first-quarter value, a decline of 31.7% on an annualized basis. This

decline was accompanied by a sharp decrease in employment – 22.8 million

jobs were lost in March and April, and unemployment rose from its

lowest level in 50 years in February (3.5%) to 14.7% in April, the

highest rate since the Great Depression.

The study broke out several key measures by commercial real estate industry sector:

Office construction expenditures totaled $38.8 billion in 2020, down 28.5% from 2019 after increasing 12.7% in 2019.

Retail

construction expenditures totaled $11.7 billion in 2020, a decrease of

29.5% from 2019. This decrease marks the fifth straight year of decline;

expenditures fell 2.3% in 2019; 9.5% in 2018; 0.8% in 2017; and 7.0% in

2016. The last time retail construction spending increased was in 2015.

Warehouse

construction outlays only decreased marginally in 2020, down 0.3% from

2019. In 2019, construction spending had been up sharply (27.4%),

continuing a positive trajectory that began in 2011.

Industrial

(manufacturing) construction spending was hard hit by the contraction

in 2020, declining 29.5%. During the past five years, industrial

construction spending had declined sharply in 2015 and 2016 before

increasing in 2017 and 2018 and declined 1% in 2019.

The report reveals that while 2020 was not the year that had been expected, 2021 will be a recovery year:

Job

growth and unemployment rates will continue to improve but are not

expected to regain prepandemic levels; full employment is not projected to be reached until mid-2022, and unemployment is projected to remain above 4% through 2025.

All

GDP growth in 2021 will be make-up or replacement growth that was lost

or foregone in 2020. So, while a seemingly robust 4% GDP growth is

projected for 2021, all of this new GDP value will be needed to bring

the value of total GDP near to the pre-pandemic level of February 2020.

“Many

factors point to a commercial real estate rebound in 2021,” said Thomas

J. Bisacquino, president and CEO of NAIOP. “Obviously we dealt with

several unknowns and an unexpected downturn in 2020; however, we believe

that while the pandemic has accelerated trends already progressing in

real estate, we have a bright future. Office workers will return to the

offices with some regularity in 2021, the industrial and warehouse

sectors will continue to expand as e-commerce demand intensifies, and

the retail sector will be reshaped as the shopping experience evolves.”

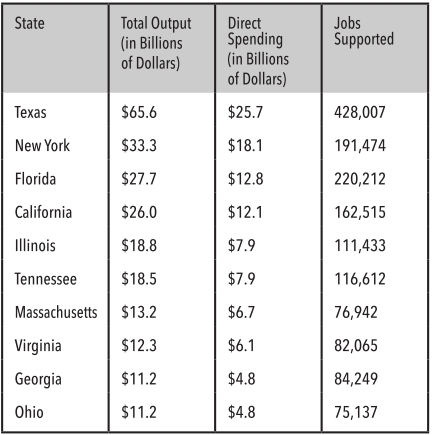

Top

10 States by Development Impacts in 2020 The following are the top 10

states by development impacts (ranked by total output), with California

in fourth place.

The full report includes

detailed data on commercial real estate development activity in all 50

states and the District of Columbia, including direct spending; total

output; salaries and wages; and jobs supported.

The

“Economic Impacts of Commercial Real Estate” report is authored

annually by economist Stephen S. Fuller, Ph.D., with data provided by

Dodge Data & Analytics.

Since

2008, NAIOP has conducted this study for purposes of estimating the

annual economic contribution of commercial real estate development to

the U.S. economy. This study is used by real estate professionals and

municipal, state and federal officials and employees to understand and

quantify the key economic benefits of commercial real estate

development.

For more information, visit naiop.org.