This month’s top deals from around Southern California

Culver City Plant-Based Food Manufacturer Daring Foods Acquired by Australian Firm

Daring Foods, a Culver City-based food manufacturer focused on plant-based meat substitutes, was acquired by Australian firm V2food for an undisclosed amount. The company had generated annual revenue of about $30 million from products sold in thousands of stores that include major grocers Whole Foods and Walmart.

“Daring has built an incredible, consumer-loved brand with strong reach across the U.S., and combining that with our food technology creates immediate opportunities to accelerate our mission to be one of the global leaders in plant-based protein,” said Tim York, chief executive of V2food, in a statement.

The company was founded in 2018 and raised more than $120 million to develop and expand its product line. It reached a valuation of $329 million in 2021.

Sourced from V2food.

Lake Forest-based Staar Surgical to be Acquired in $1.5 Billion Transaction

Global eye care company Alcon announced the acquisition of Lake Forest-based Staar Surgical Co. in a transaction with a total equity value of approximately $1.5 billion. Under the terms of the agreement, Alcon will purchase all outstanding shares of Staar common stock for $28 per share in cash, which represents approximately a 59% premium to the company’s 90-day volume-weighted average price and a 51% premium to the closing price of Staar common stock on August 4 when the deal was first announced.

“With the number of high myopes rising globally, the acquisition of Staar enhances our ability to offer a leading surgical vision correction solution for those who are not ideal candidates for other refractive surgeries such as Lasik,” said David Endicott, chief executive of Alcon, in a statement. “This transaction will allow us to provide treatment options across the full spectrum of myopia from contact lenses to surgical interventions.”

An estimated 50% of the world will be myopic by 2050, and today nearly 500 million people are considered high myopes. Staar manufactures a family of contact lenses for vision correction for patients with moderate to high myopia (nearsightedness), with or without astigmatism.

The transaction is not subject to a financing condition. Alcon intends to finance the transaction through the issuance of short- and long-term credit facilities. It is anticipated to close in approximately six to 12 months.

Sourced from Staar Surgical Co.

Levine Leichtman Capital Partners and Management to Acquire Shipley Do-Nuts

Levine Leichtman Capital Partners, a Los Angeles-based private equity firm with $12.7 billion in assets under management, partnered with company management to acquire Shipley Do-Nuts from Peak Rock Capital. Financial terms of the transaction were not disclosed.

Houston-based Shipley bills itself as the nation’s largest donut and kolache brand with 375 locations across 14 states that provide more than 60 varieties of handcrafted, fresh-made-daily donuts, kolaches and coffee. It was founded in 1936 and is headquartered in Houston, where it will continue to be operated by the existing management team led by Flynn Decker, chief executive.

“We see a tremendous opportunity to build on this foundation by expanding unit count even further to capture the substantial whitespace and driving strong same-store sales growth,” said Matthew Frankel, managing partner of Levine Leichtman, in a statement.

Shipley is the fourth platform investment of Levine Leichtman Capital Partners VII LP. It represents the firm’s 18th franchising investment, with a combined 32 brands across a variety of industries.

“We are excited to leverage our extensive experience investing in the franchising space to pursue various growth initiatives alongside them,” said Greg Flaster, managing director at Levine Leichtman, in a statement.

Kirkland & Ellis LLP and DLA Piper served as legal counsel to Levine Leichtman on the transaction. Shipley was advised by North Point and J.P. Morgan.

Sourced from Levine Leichtman Capital Partners.

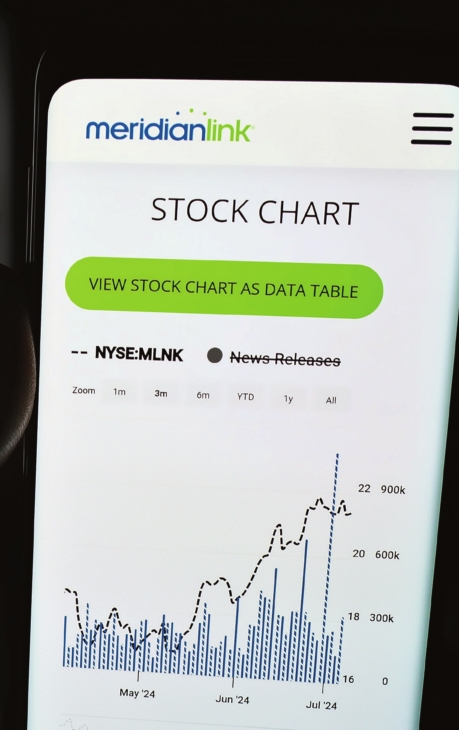

Irvine-based MeridianLink to Go Private in $2-Billion Transaction

Irvine-based MeridianLink Inc., a provider of modern software platforms for financial institutions and consumer reporting agencies, entered into an agreement to be acquired by funds advised by affiliates of Centerbridge Partners LP in an all-cash transaction that values MeridianLink at an enterprise value of approximately $2 billion.

Upon closing of the transaction, MeridianLink will become a private company. MeridianLink shareholders will receive $20.00 per share in cash for each share of common stock they own. That represents a premium of approximately 26% over the closing price of MeridianLink shares as of August 8, the last full trading day prior to the transaction announcement.

“Today’s announcement is a strong endorsement of our leading digital lending platform that serves nearly 2,000 community financial institutions and reporting agencies,” said Larry Katz, president and chief executive-designate of MeridianLink, in a statement. “Together with Centerbridge, we will unlock the potential of this company by accelerating product innovation, harnessing the power of AI and data and enhancing the delivery of exceptional customer experiences.”

The MeridianLink Board of Directors unanimously approved the transaction, which is expected to close in the second half of 2025, subject to regulatory approvals and customary closing conditions.

Upon completion of the transaction, MeridianLink’s common stock will no longer be listed on any public market. The private company will remain headquartered in Irvine.

Sourced from MeridianLink Inc.

-David Nusbaum