Exceeding Expectations...

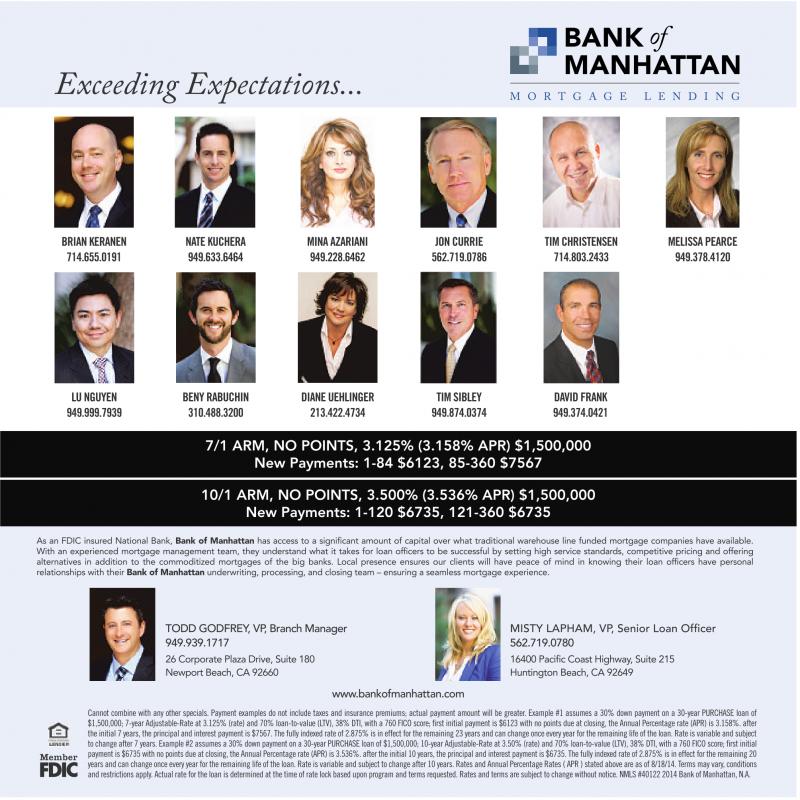

BRIAN KERANEN 714.655.0191

NATE KUCHERA 949.633.6464

MINA AZARIANI 949.228.6462

JON CURRIE 562.719.0786

TIM CHRISTENSEN 714.803.2433

MELISSA PEARCE 949.378.4120

LU NGUYEN 949.999.7939

BENY RABUCHIN 310.488.3200

DIANE UEHLINGER 213.422.4734

TIM SIBLEY 949.874.0374

DAVID FRANK 949.374.0421

7/1 ARM, NO POINTS, 3.125% (3.158% APR) $1,500,000 New Payments: 1-84 $6123, 85-360 $7567

10/1 ARM, NO POINTS, 3.500% (3.536% APR) $1,500,000 New Payments: 1-120 $6735, 121-360 $6735

As an FDIC insured National Bank, Bank of Manhattan has access to a significant amount of capital over what traditional warehouse line funded mortgage companies have available. With an experienced mortgage management team, they understand what it takes for loan officers to be successful by setting high service standards, competitive pricing and offering alternatives in addition to the commoditized mortgages of the big banks. Local presence ensures our clients will have peace of mind in knowing their loan officers have personal relationships with their Bank of Manhattan underwriting, processing, and closing team – ensuring a seamless mortgage experience.

TODD GODFREY, VP, Branch Manager 949.939.1717 26 Corporate Plaza Drive, Suite 180 Newport Beach, CA 92660

MISTY LAPHAM, VP, Senior Loan Officer 562.719.0780 16400 Pacific Coast Highway,Suite 215 Huntington Beach, CA 92649

www.bankofmanhattan.com

Cannot combine with any other specials. Payment examples do not include taxes and insurance premiums; actual payment amount will be greater.Example #1 assumes a30% down payment on a30-year PURCHASE loan of $1,500,000; 7-year Adjustable-Rate at 3.125% (rate) and 70% loan-to-value (LTV), 38% DTI, with a760 FICO score; first initial payment is $6123 with no points due at closing, the Annual Percentage rate (APR) is 3.158%. after the initial 7years, the principal and interest payment is $7567. The fully indexed rate of 2.875% is in effect for the remaining 23 years and can change once every year for the remaining life of the loan. Rate is variable and subject to change after 7years. Example #2 assumes a30% down payment on a30-year PURCHASE loan of $1,500,000; 10-year Adjustable-Rate at 3.50% (rate) and 70% loan-to-value (LTV), 38% DTI, with a760 FICO score; first initial payment is $6735 with no points due at closing, the Annual Percentage rate (APR) is 3.536%. after the initial 10 years, the principal and interest payment is $6735. The fully indexed rate of 2.875% is in effect for the remaining 20 years and can change once every year for the remaining life of the loan. Rate is variable and subject to change after 10 years. Rates and Annual Percentage Rates (APR )stated above are as of 8/18/14. Terms may vary,conditions and restrictions apply.Actual rate for the loan is determined at the time of rate lock based upon program and terms requested. Rates and terms are subject to change without notice. NMLS #40122 2014 Bank of Manhattan, N.A.