It’s about time.

©2018Bank of Hope,NMLS#794513

bankofhope.com

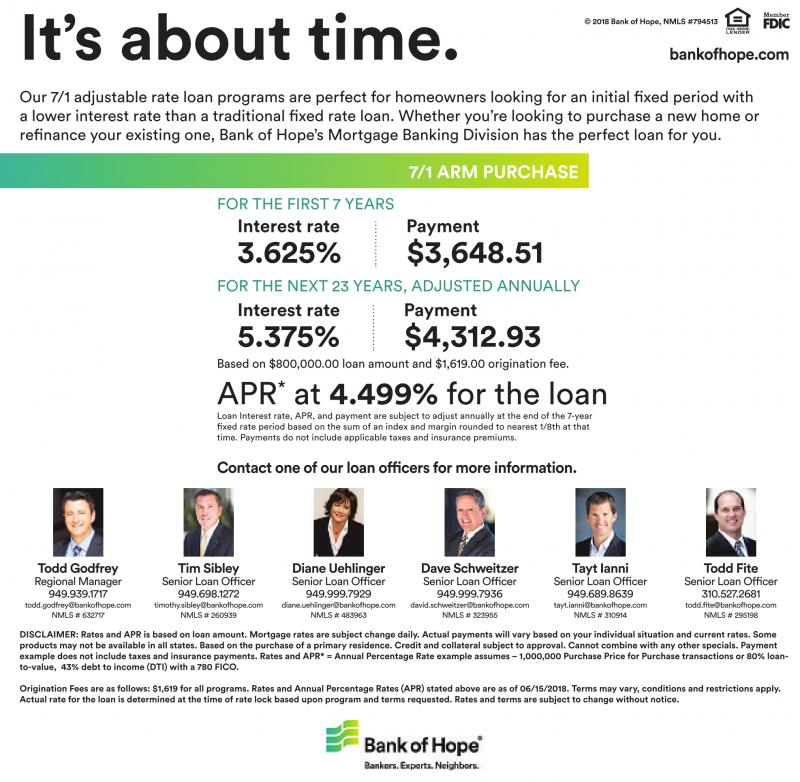

Our 7/1 adjustable rate loan programs are perfect for homeowners looking for an initial fixed period with a lower interest rate than a traditional fixed rate loan. Whether you’re looking to purchase a new home or refinance your existing one, Bank of Hope’s Mortgage Banking Division has the perfect loan for you.

7/1 ARM PURCHASE

FOR THE FIRST 7 YEARS

Interest rate

3.625%

FOR THE NEXT 23 YEARS, ADJUSTED ANNUALLY

Interest rate Payment

5.375%

Payment

$3,648.51

$4,312.93

Based on $800,000.00 loan amount and $1,619.00 origination fee.

APR

*

at 4.499% for the loan

Loan Interest rate, APR, and payment are subject to adjust annually at the end of the 7-year fixed rate period based on the sum of an index and margin rounded to nearest 1/8th at that time. Payments do not include applicable taxes and insurance premiums.

Contact one of our loan officers for more information.

Todd Godfrey RegionalManager 949.939.1717

todd.godfrey@bankofhope.com NMLS #632717

Tim Sibley Senior Loan Officer 949.698.1272

timothy.sibley@bankofhope.com NMLS #260939

Diane Uehlinger Senior Loan Officer 949.999.7929

diane.uehlinger@bankofhope.com NMLS #483963

Dave Schweitzer Senior Loan Officer 949.999.7936

david.schweitzer@bankofhope.com NMLS #323955

Tayt Ianni Senior Loan Officer 949.689.8639

tayt.ianni@bankofhope.com NMLS #310914

Todd Fite Senior Loan Officer 310.527.2681

todd.fite@bankofhope.com NMLS #295198

DISCLAIMER: Ratesand APRisbased on loan amount. Mortgage rates aresubject change daily.Actual paymentswill varybased on your individual situation and currentrates. Some products maynot be available in all states. Based on thepurchaseofaprimaryresidence. Credit and collateralsubject to approval.Cannotcombine withany otherspecials. Payment example does notincludetaxes and insurancepayments. Rates andAPR*=Annual Percentage Rate exampleassumes –1,000,000 PurchasePricefor Purchasetransactions or 80%loanto-value, 43% debttoincome (DTI) witha780 FICO.

Origination Fees are as follows: $1,619for all programs. Rates andAnnual Percentage Rates (APR)stated above areasof06/15/2018. Termsmay vary,conditions and restrictions apply. Actual rate forthe loan is determined at thetime of rate lockbasedupon program and terms requested.Ratesand terms are subject to change without notice.